Inheriting property can be a bittersweet situation. Most likely a loved one has passed away. This may be an emotional time and sometimes an unexpected event. It is so important to reach out for expert advice so that you can make good decisions for yourself as well as for any potential beneficiaries. Many questions may arise, specifically, “what to do?” which can lead to feeling overwhelmed. Depending on the circumstances, you will most likely need help to manage the process of what is to be done with the real property that remains. Depending on how the real property was vested upon the decedent’s death will determine your options and course of action.

Vesting in California

The most common ways to hold Title of Real Estate (Vesting):

- Living Trust

- Community Property

- Community Property with Right of Survivorship

- Joint Tenancy (Joint Tenants)

- Tenancy in Common (Tenants in Common)

- Sole Owner

Unfortunately, many people did not seek or think they needed an attorney to guide them in selecting the best way to hold Title to a property. Many years ago, it was common for spouses to just take Title as Joint Tenants. No issues were presented at the time when one spouse passed, but in the unfortunate event that the other passes, probate is necessary. Unfortunately, joint tenancy does not provide a plan, unlike a living trust, in the event the remaining spouse passes away. A Living Trust would provide the desired plan on naming someone to carry out the wishes of the Estate. A plan determining what to do with real estate, valuables, financial accounts, and even pets for example.

Essentially, probate can be a complex process. If the property is to be sold, it is beneficial to work with a probate transaction expert. Suzanne and her team, work with families and real estate attorneys regularly to provide the necessary expertise to help Executors and Personal Representatives go through the probate process successfully.

What Is Probate?

Unfortunately, Probate is a word that is spoken by many, but often not completely understood. Many people understand probate as a situation where someone has died without a Trust. This is true, but probate is so much more. Probate is a legal process by which the probate court must confirm a deceased person’s will or appoint someone to manage the decedent’s assets as well as pay any debt owed at the time of death. If there is a will, the probate court will appoint an Executor and if there is not a will, an Administrator will be appointed. The Executor or Administrator will collect the assets, pay the debts, taxes, and expenses, and then distribute the remainder of the estate to those who have the legal right to the inheritance, also known as beneficiaries. Please note that there is a simplified way of transferring property to your name from an inherited property if the value of the real property is worth less than $166,250.00.

Which Assets are Probated?

Not all assets the decedent owns are probated. The following are most likely going to need to go through the probate process:

Assets that are in the deceased name only that are separate, acquired outside of marriage, or inherited during a marriage. Items can be categorized as Tangible and Intangible.

Including, but not limited to,

- Real Estate

- Insurance Policies (no beneficiaries listed)

- Bank Accounts (no beneficiaries listed)

- Investment Accounts (no beneficiaries listed)

- Retirement Accounts (no beneficiaries listed)

- Jewelry

- Artwork

- Vehicles

- Boats

- Airplanes

- Furniture

- Electronics

- Computers/Laptops

How Long Does Probate Take?

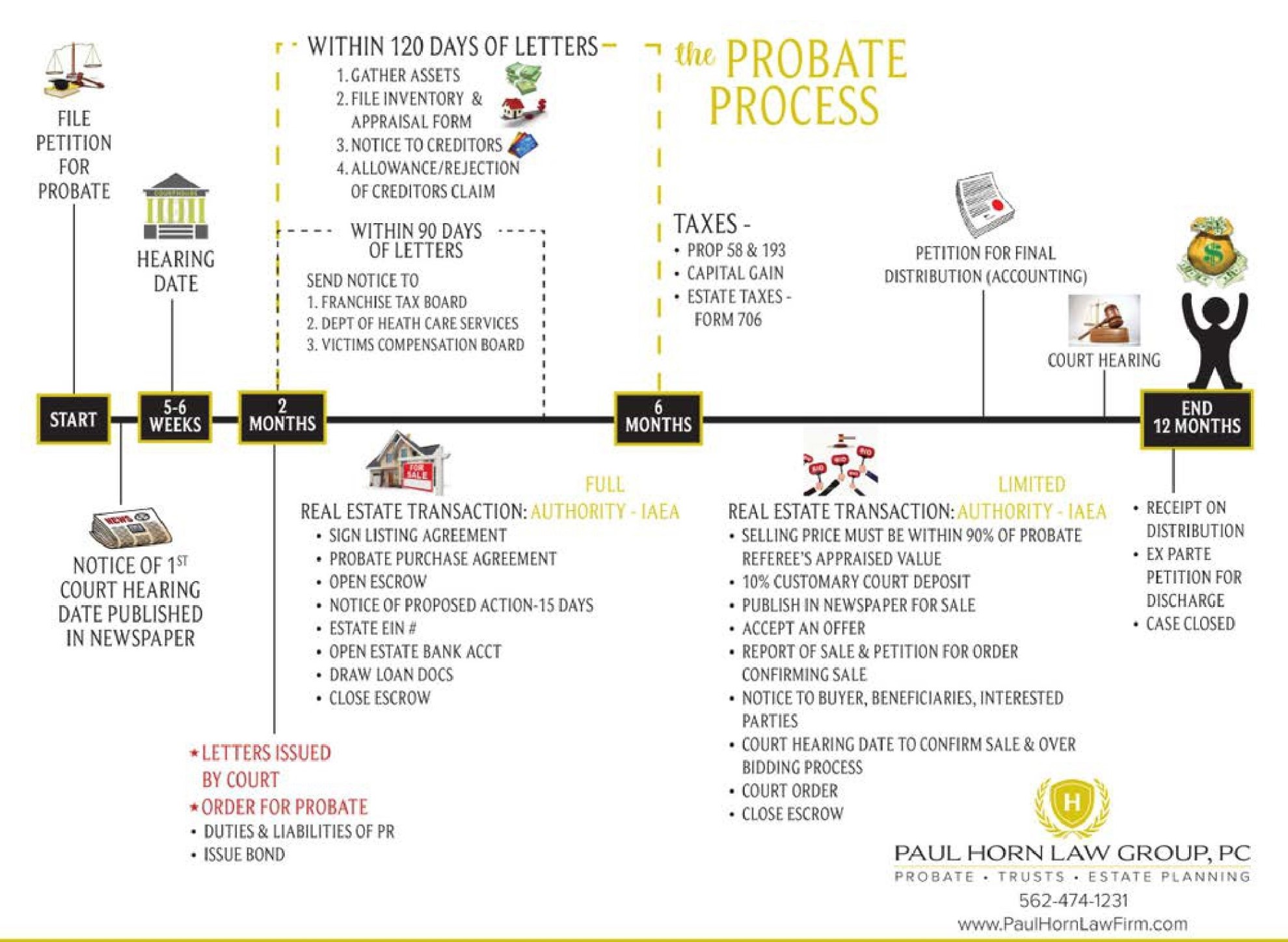

The probate process can take anywhere from 9 to 18 months to a year to complete the entire probate process that entails a straightforward case. Keep in mind, every situation may be different so there may be some exceptions.

This Diagram provided by Probate Attorney Paul Horn is a general guide.

Selling a Property in Probate

When a Personal Representative is appointed, they have the right to execute a listing agreement for the sale of the real property. Oftentimes, resources may be essential if the property needs to be cleared out, items need to be sold via an estate sale, or perhaps small projects completed. This is where Suzanne and the team at Cal Home come in. Again, the focus is on reducing stress as much as possible. We offer an array of resources to help every step of the way.

It is also important that probate experts work with your Attorney/legal representatives, Accountant, and a Title Company to ensure all necessary steps are taken to sell the home appropriately.

Selling a Property from a Living Trust

Perhaps you have inherited a property that was placed in a Trust. This is a much easier situation and may not involve a probate court. In other words, as a legal heir you can inherit real property directly if the home was placed in a Trust. Circumstances vary if anyone contests the Trust which would then require legal representation.

For straightforward situations, selling an inherited home from a Trust would not be as complex and similar to selling any other property.

Bottom line, if you are unsure if your situation would be a matter for the probate process, give us a call to guide you. We have years of experience in probate and inherited property sales. We offer an array of resources including referrals for Probate Attorneys.